Personal Finance for Beginners – How to Dominate Your Money

This post may contain affiliate links. If you purchase a product through one of them, we will receive a commission at no additional cost to you. As Amazon Associates, we earn from qualifying purchases.

This post is all about personal finance for beginners.

“Personal Finance 101.”

We don’t learn about it in school.

It’s not part of the curriculum, on the whole, in America.

Folks are starting to catch on, and even vocalize their disdain at that fact.

…DUH GUYS! If they taught us how to make good financial decisions, compound interest would work for us instead of against us. Credit card companies would go out of business. Car sales would no longer be profitable. Capitalism would croak!! People would spend wisely instead of outside their means. It would totally kill profits for just about everything!

Or, in actuality….

None of this would happen. Seemingly, no matter the required curriculum in schools, some fools don’t pay attention and make poor decisions anyway.

BUT!

If “they” did teach personal finance in schools, what would they teach? Where would they start?

I have some ideas.

Now, let me be clear – I am a random person on the internet, and this is not professional advice.

However, I do feel qualified to write this post. As compared to the average American my age, my income level is relatively low but my savings level is relatively high. I paid off my student loans in 4 years (see also: Side Jobs to Pay Off Student Loans) and among those was a year of service – as in, a volunteer year, no full-time income.

Sources for Personal Finance for Beginners

I also personally took it upon myself to earn a financial education. On my own. Via the library.

Did you know? Most municipalities in America have libraries, and all you need to do to check the books out is show a proof of residency and be patient with the cranky librarian (…just me who got scolded as a grown-ass adult for forgetting her card?).

Books I’ve read that are related to personal finance and therefore fuel this post:

- Smart Couples Finish Rich – David Bach

- Richest Man in Babylon – George Samuel Clason

- Automatic Millionaire – David Bach

- Rich Bitch – Nicole Lapin

- The Book of Proverbs

- Invested – Danielle Town

- Payback Time – Phil Town

- Rule #1 – Phil Town

- Rich Dad, Poor Dad – Robert Kiyosaki

- Set for Life – Scott Trench

- Atomic Habits – James Clear

- Soldier of Finance – Jeff Rose

- Grit – Angela Duckworth

- The Compound Effect – Darren Hardy

- Meet the Frugalwoods – Elizabeth Willard Thames

It is from these books I have drawn these 8 conclusions. Tenets, if you will.

Derek and I may not have a gazillion dollar net worth (YET!), but I am here to say, living with these themes has yielded us not only a faster track to financial freedom, but also an easier time sleeping at night.

Related: Best Five Books that will jumpstart your Personal Finance Health

Spend Less Than You Make

This one is logical, but given that the average American credit card debt in 2021 is still $8,000 (according to CNBC as of March 2021)… Clearly, something is still not adding up!

The core of any successful personal financial endeavor can be boiled down to this one rule: Spend less than you make.

I know, I know, there are all kinds of hocus pocus conversations about leverage and debt and good debt and bad debt and a whole bunch of other hullabaloo.

Every wise individual who has written about personal finance expands upon this same theme. If you cannot control your spending, you will have a very hard time progressing towards any kind of saving or investing.

Which brings me to point #2, a blue-collar quip from my dad…

Money in Beats Money Out

My Dad is fountain of good advice for a successful life, and has even written a book about it.

“Money in beats money out” is one of Dad’s mantras, and I believe he’s right. Money coming into your bank account is better than money leaving your bank account.

This phrase can be applied to many an endeavor:

“Should I take that extra gig this weekend… ? Meh, I’d only earn $200…”

“Money in beats money out.”

“Is it worth it if I rent out a parking space on my property for a few extra bucks?”

“Money in beats money out.”

“I guess I could sell a few items on Poshmark each month for like, $30…”

“Money in beats money out.”

These examples may represent small steps when your financial goals include 6 figures of student loan debt or even retiring a millionaire someday.

But you MUST believe that small steps will turn into leaps and bounds! Dave Ramsey, the debt-free king himself, regularly reinforces that baby steps lead to massive wealth building.

A few bucks coming in is better than hemorrhaging your coins. Boom.

(Most) Debt Is Bad

I know, I know, before you assault me with phrases like “good debt” and “low interest rates”, let me explain.

We are talking principles of personal finance for beginners here.

Tenets. NOT exceptions.

So, please hear me out.

The borrower is slave to the lender.

Those are wise words of Solomon in the book of Proverbs, and whether you believe the Bible is comprised of holy words from God or merely good philosophy, it is hard to argue that the lender would be slave to the borrower.

Debt is generally not a good idea, particularly for the financial novice. Debt can cripple a person’s financial health. Credit card debt, student loan debt, consumer debt, car payment debt, peer to peer debt, you name it, they’re all worse than the last!

Now, I know, this is a real estate blog and mortgages exist so that people can buy houses.

One could argue that “good debt” is the kind of debt that one can outpace with a faster growing investment. (We’re delving away from “Personal Finance for Beginners” and briefly into “Personal Finance for the Intermediate”).

For example, a mortgage could easily be obtained in the year 2021 for a 4% interest rate. The average return on the S&P 500 is, for cocktail party standards, 7%.

I’m sure there is an army outside my door right now, poised and ready with pitchforks to tell me that a mortgage is “good debt,” which an easy stock market investment could outpace, and one’s net worth could not possibly grow without it.

Ok, strong laden army, I agree to a point, but this is only applicable if you have already paid off everything else and you are free to invest your extra income profitably.

If you don’t have any extra income, please backtrack to #1, above, and spend less than you make.

The debt conversation has entire books and podcasts and debates awaiting.

My basic assessment here, though, in this basic overview of personal finance for beginners, is that at least 80% of the time, debt won’t help you reach your personal finance goals.

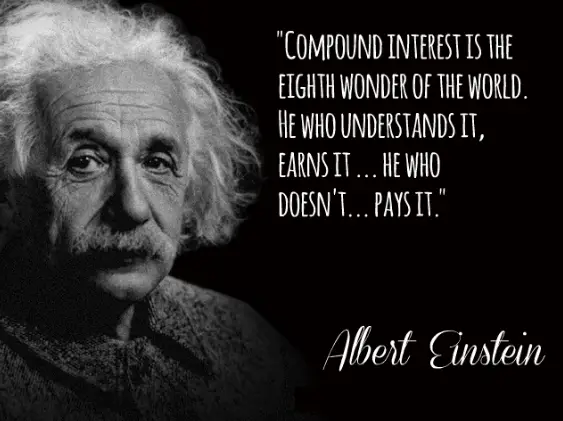

Compound Interest Is Immensely Powerful

Whether it works for you or against you, compound interest is….

Well, let’s turn to Einstein, who is obviously smarter than I:

Compound interest is the 8th wonder of the world, and understanding it is essential to passing Personal Finance 101.

What is it, exactly?

“Compound interest (or compounding interest) is the interest on a loan or deposit calculated based on both the initial principal and the accumulated interest from previous periods. Thought to have originated in 17th-century Italy, compound interest can be thought of as ‘interest on interest,’ and will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount.”

Compound Interest Can Work for You…

If you are earning compound interest, say, on a stock market investment of $100:

Year 1: $1,000 invested.

Year 2: Now you have $1,070. It earned 7%, yay you!

Next, it earns 7% on $1,070 instead of just $1,000.

Year 3: Now it’s $1,144. 7% more…

Year 4: $1,225, which becomes $1310.

And so forth. Over 4 years, your $1,000 investment grows to $1,310. Go you!

If you’re looking to see how much a certain number will gain over time, Money Geek has a nifty calculator to play with investment numbers.

Or, Compound Interest Can Work Against You…

It works the other way around, too:

If compound interest is working against you, say in the form of debt, your quicksand pit will inevitably grow. If you are paying compound interest on a loan, say at a 7% interest rate on a set of shiny new wheels…

Let’s turn to Credit Karma’s debt repayment calculator.

$1000 loan (for comparison’s sake. Obviously, a car costs more than $1000.)

After 48 months of payments at 7% interest, your $1,000 purchase actually costs you $1,149.

To sum it up, ‘tis better to have compound interest working for you than to have it working against you.

Pay Yourself First

This is a mindset lesson.

For anyone who has bills to pay, it seems funny to say, “pay yourself first.”

How can I do that, when I have to pay Uncle Sam, rent/mortgage, utilities, internet, cell phone, groceries, travel expenses, etc. etc. etc.? Don’t I just save whatever is leftover?

Nope.

The wisest writers say that you get to pay you before anyone else.

For some people this is 5% off the top number, straight into a savings or retirement account. For others, this is 15%. Regardless of your do-able savings number, declare it today:

You don’t get the leftovers.

You get the first slice of pizza.

You get the first, almighty, glorious cup of coffee from the carafe.

This is basically a form Insta-worthy “self-care”.

You are in control of the money that comes in – no one else, regardless of what debt you have – and whether that’s 15 cents per month or $1,500 per month, you put aside what you want for future you.

Save 10% Of Everything You Make

This is similar to “paying yourself first.”

For personal finance for beginners, a reasonable savings goal is 10% of your money.

This may initially sound unachievable. If you’re not used to it, this may take time to adjust.

I am here to tell you that with enough discipline, you can do it.

You will come to realize that after a while, you won’t feel it and this little action will become a habit.

How do you implement it?

I have two techniques to offer.

- If you’re so lucky to work a steady job with a W2, you can reach out to HR or Payroll and re-route your paycheck so that you don’t even see that 10% hitting your checking account. You’ll adjust to living off of 90% of your money, and off you go to delight in your mastery of Personal Finance 101.

- If you’re a freelancer like me and work for 20 different employers every year (no, that’s not an exaggeration, and yes, our accountant, bless him, is very patient), then you must be a bit more careful. Whenever your moolah hits the bank, whether that be via Venmo, check, transfer, Paypal, Zelle, or the 8,000 other ways freelancers seem to get paid, you must budget your money and transfer it yourself.

I personally do this on a monthly or bi-monthly basis, moving money from checking to retirement and savings accounts. I keep an excel spreadsheet and DO NOT TOUCH my 10% money. Ever. If I earn $100 at a gig, $10 goes into savings. If I earn $5,000 on a gig, $500 goes into savings.

I’ve been doing this for 15 years and can honestly say, in a field earning less than the average American my age, I have more than the average bear to my name. Not bragging, rather, I’m telling you this is totally possible, and if I can do it so can you!

Want to save even more? Check out One Simple Tactic to Save $600 Annually.

You Need a Budget

Do you honestly know what you are spending per month on your existence?

Can you give me a number, right now, of how much you would need to survive 1 month, 3 months, 6 months without your job? Do you know the difference between your necessary and discretionary spending habits?

No?

You need a budget.

Maybe you have a “mental budget”, and you think, eh, “I know roughly what I’m spending per month on streaming services.” Maybe you do.

I dare you to track it for three months and reassess.

A written picture of your expenses will free you to make more accurate decisions, like setting your best budget to buy a house. It will display, on paper, what you deem important. It may be a wakeup call that “fun you” is spending more than “goal-oriented you” thinks is wise.

Creating a written budget is essential for success in personal finance for beginners.

Wherever “there” is for you, you will get there faster with a written budget.

Let yourself face your facts.

Budget.

Need help? Go to 9 Best Budgeting Resources for Your Investment Journey.

Assets > Liabilities

The who and the whaaaatttt?

Basically: assets increase your net worth. Liabilities decrease your net worth.

An example of an asset would be a rental property. It earns you money, and often passively, too!

An example of a liability would be your car. It drains your money while never increasing in value. In fact, cars decrease their value the moment you drive them off the lot after buying.

Assets, for your personal finance bottom line, are better than liabilities. More assets = more money, faster. More liabilities = less money, faster.

Robert Kiyosaki explains this very, very well in Rich Dad, Poor Dad. Most wealthy individuals have assets working for them, and continue to acquire more assets on a regular basis.

Discipline Is the Bridge Between Goals & Accomplishment

That’s a quote by motivational speaker Jim Rohn.

King Solomon himself said it in Proverbs, too– slightly different, mostly similar: “The plans of the diligent are sure of profit.”

Whatever the quote that gets your motor running, the crux here is that little choices every day will add up to massive success.

Like a ballet dancer who pliés daily, or a basketball player who practices 1,000s of jump shots, the financially savvy individual (that’s you!) trusts that small actions become big habits, and over time, you will reach your goal.

There you go! Personal Finance for Beginners, as told by a humble average earner addicted to disciplined financial decisions.

I hope you are now motivated to spend less than you make, stay out of debt, pay yourself first, save at least 10%, make that budget, and invest in some assets!

What would you include in this list?