Awesome Side Jobs to Pay off Student Loans: Proven Ways to Crush Your Debt

This post may contain affiliate links. If you purchase a product through one of them, we will receive a commission at no additional cost to you. As Amazon Associates, we earn from qualifying purchases.

If you’re looking for side jobs to pay off student loans, you’ve come to the right place.

After polling many a millennial friend and colleague, it seems that one of the biggest barriers to purchasing a home is massive college debt.

I’ll hold off on a drunken tirade regarding the status of exponentially increasing higher ed tuition costs. We don’t have time to wallow in our enormous-decisions-made-at-18-years-old-without-realizing-what-it-meant-to-acquire-6-figures-of-debt.

We’re talking solutions today.

Before we dive in, I have four things I’d like you to know.

- I understand if you don’t want to buy a house (thus likely acquiring more debt in a mortgage) if you have dealt with large debt like student loans in any way, shape, or form.

- I acknowledge that our millennial generation was encouraged to go to college, arguably to a fault, while college tuition prices are increasing faster than any other time in history.

- We are not talking possible loan forgiveness or politics today because (a) my blood pressure can’t handle it, and (b) relying on the government to solve our problems might take a while.

We’re going to do what we can for ourselves ASAP, and if Uncle Sam tosses in a helpful program, then that’s a bonus we will employ to our advantage. Until then, we’ll make our own party. - The easiest way to make money is to make your money work for you. However, this is difficult when you don’t have any money to start with.

Until you’re rocking passive income, let’s work on earning cash flow, getting out of debt, and saying sayonara to that wench Sallie Mae.

Hence, most of the following solutions will relate to employment rather than investing.

Ready?

Let’s go.

Steady Part Time Work

Is there a weekend job you can tack on to earn more money? Assuming you work a 40-hour/week day job, that leaves Saturday and Sunday to bump up your earning power.

Steady part time work is one of the best side jobs to pay off student loans. It may be exhausting, but it also may only be temporary.

Furthermore, a lot of part time work can be seasonal (thinking landscaping, catering, or retail here), and you can emphasize while interviewing that even though this job won’t be your main squeeze, you’ll be available for weekends and holidays when the regular staff will not.

Ideas

- Barista

- Wait tables

- Bartending

- Birthday party entertainment

- Contractor over hire

- Landscaping

- Retail

- Catering

My Experience

I was a birthday party princess.

This was preceded by my ingesting a giant slice of humble pie.

Nevertheless, I pounded money into my student loans thanks to this weekend job.

Here’s my detailed, gory experience.

If there is a princess, I have played her. Yes, this blue-eyed pale Irish lass has played Cinderella, Ariel, and Belle. Yes, this blue-eyed pale Irish lass has also played Princess Jasmine and the Beast. (My stomach still turns just thinking about that one). I drew the line at Tiana and the Frog, as that would approach illegal forms of entertainment not seen since the days of Al Jolson.

Princess Jasmine happened only once, with a lot of bronzer, on the Upper East Side of New York City, where children mature exponentially faster than anywhere else in the country. The five-year-old birthday girl took one look at me, and without flinching turned her eyes to her mother, speechlessly communicating, “Seriously?” and spun around to reject my fine dress-up efforts.

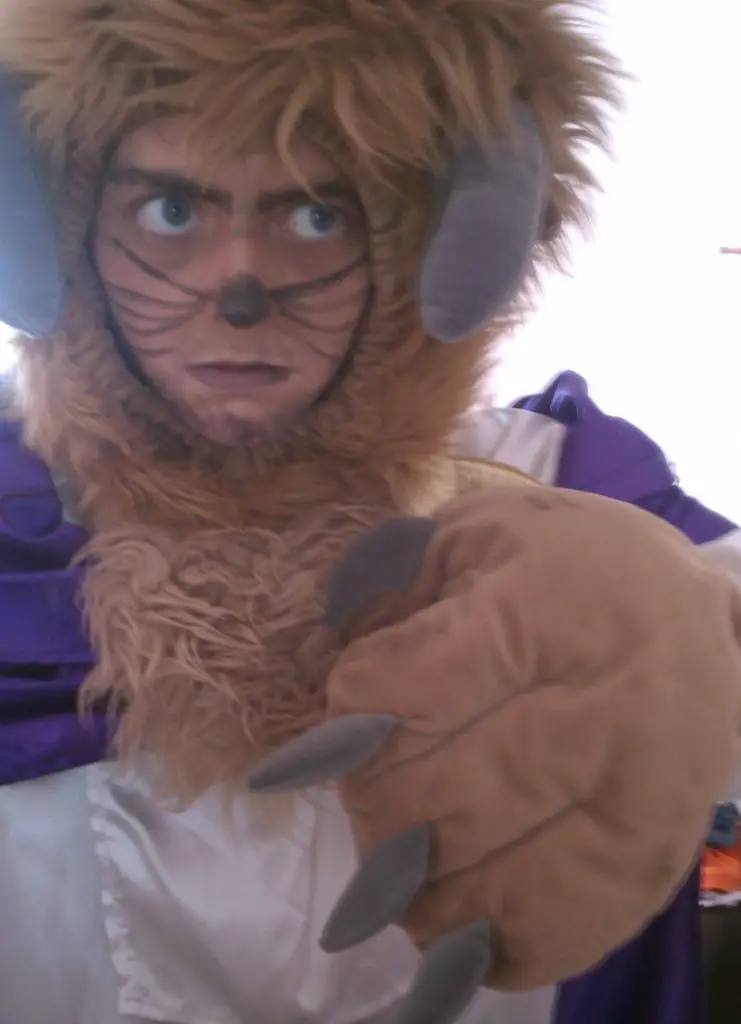

The Beast occurred when all the “princes” on staff were unavailable, and I, the tallest female, got the gig.

My boss promised that the client knew that a woman would be playing the beast. The birthday girl was four and would never know, but they really wanted the fairy tale couple and not another princess instead.

Hokay, boss….

I stuffed two hoodies under my costume, you know, to bulk up, carefully painted face whiskers with my favorite eyeliner, and puffed out my chest like I meant business.

Princess Belle entered the party, much to the partygoers’ delights. She introduced the “next very special guest,” and into the party I swooped with a roar, and…

…the birthday girl burst into tears and fled the room.

I felt 20% badly and 80% proud of myself for playing so scary a Beast that school-aged children ran for cover.

Sigh. The things we do for money.

Perks

- A fine diet of leftover pizza and pink frosted cupcakes.

- Incomparable freeze dance and face painting finesse.

- Ninja hibachi cake cutting skills.

And…

…TIPS.

Possible Income

I packed in 3 to 6 parties per weekend, averaging $20-$40 in tips per party on top of our gig pay. This averaged out to about $600/month. After saving my 10% for me, I stacked all of it towards my student loans.

What about you? Is there a birthday party company in your town, whether it’s a trampoline center or circus themed? The birthday party business will likely always be in business, and if there’s a population of young children in your town, it grows like wildfire.

Pop up Gigs

Also known as 1099 income, “gig life” offers quite profitable side jobs to pay off student loans if you hang with the right cats. Typically, this means a company will need to hire someone on a one-off job.

If you earn more than $600 in a calendar year from any one company, you’ll have to file taxes and pay the government their share.

If you make less than $600, Uncle Sam says it’s small potatoes and you can keep it all! Not bad, right?

Ideas

My knowledge runs around the entertainment world, so my ideas for this include:

- Print modeling

- Music gigs

- Graphic design

- Commissioned art pieces

- Painting miniature gaming pieces

- Baby sit / nanny

- Clean houses

- App employment (Door Dash, Uber, etc).

My Experience

Somewhere around September of 2011, the fabulously creative Tryon Entertainment had a casting call for dancers above 5’9” with weekend availability. I applied, and a month later I was playing a walk-around Catwoman at a very wealthy child’s superhero-themed bar mitzvah in Manhattan.

Think Disney world, just… at a private party.

It was my first exposure to the “gig circuit” in NYC, and I couldn’t believe that a birthday party would be so fancy.

There were all kinds of attractions just at cocktail hour – a roller blading Spiderman, a bodybuilder playing Green Lantern, an old school Batman…. I thought it couldn’t get any cooler when, for his grand entrance, the birthday boy rolled up in the Batmobile.

No, like… the actual Batmobile.

It was in town for a film shoot, and you know, they just got them to stop by.

Mind = blown.

Anyway, the wonderful thing about the gig circuit is that the more you gig, then the more you gig.

I found myself gigging on the regular – usually earning between $150-$400 a night. It was brilliant fun – playing everything from Tarzan’s Jane to a Greek Goddess to the coolest lampshade around.

I can’t tell you exactly how these are created, but I can say I’ve had a sincere amount of fun messing with partygoers who can’t tell if we are real or if we are manakins.

I’ve also heard a lifetime’s worth of pre-me-too-movement, awkward jokes from pre-me-too-movement, awkward partygoers…. sigh. Money in beats money out.

Perks

- Really terrific, ridiculous stories.

- VIP access to super cool locations.

- Free celebrity performances (it’s a trend these days… ASAP Rocky! Christopher Jackson! So fun).

- Flexible scheduling.

- Good money per hour.

Possible Income

Varies gig to gig, usually $150-$400 / night.

Do you have a hidden talent that you can market for gigs? Dust off the old saxophone and play in the pit orchestra for a local high school musical. Pick up a paintbrush and run a “Paint and Sip” on the weekends. Cash in on one of these side jobs to pay off those student loans!

Educating Other People

As a college graduate paying off your student loans, you likely have an education in a specialty field.

Why not leverage that knowledge and newly credited expertise to your advantage? Or maybe you had an extra-curricular activity which you know plenty about, and can teach others with authority on the matter.

Ideas

- Tutor students in your field

- Teach chess or math

- Tutor SATs, teach children in China how to speak English, dancing, fencing, musical instruments…

- Coach a soccer team

- Referee local hockey games…

**Be advised: Working with children (rightfully so) may require background checks and “work with children” pre-requisites. Be sure to get them!

My Experience

Continuing my theme in the arts, since that’s what I do, I eventually picked up a job teaching Irish dance in a nearby school.

The two things I loved most about this job were the children and the dancing.

The children, particularly after a day of interacting with grown adults, were a breath of fresh air. Their perspectives, energy, and joy were rejuvenating. (Ok, most days. Sometimes they just talked too much during class, but hey, they’re kids!).

Irish dancing has long been a passion of mine, and sharing my knowledge while learning ever more about my favorite dance form was truly a dream come true.

There was also a bizarre feeling that I and my fellow teachers were actually making a difference in a child’s life via this extracurricular. We could tell that some children felt that dance class was the place they could be themselves, mentally work through whatever was bothering them, and make wonderful friends.

I taught for five years at that dance school and don’t regret sharing my time there for a single minute.

Perks

- Making a difference in a child’s life.

- Making money while sharing something you enjoy.

- A change of pace from your daily slog at work.

Possible Income

Runs between $20-$75+/hour, depending on where you are and what you teach. A general class might pay less, but private lessons probably pay more.

What do you know? Whom can you teach? Everyone has a little something to share with others.

Work Your Assets, Baby!

What is an asset? According to Robert Kiyosaki, simply put: “an asset puts money in your pocket, while a liability takes money out of your pocket.”

For example, an apartment that you rent out on Airbnb is an asset; an apartment that you pay rent to is a liability.

Let’s explore some assets you can leverage to help with paying off your student loans.

Ideas

- Renting out car on Turo (our friends at Famvestor have a great post on this)

- Renting out room on Airbnb or long-term lease

- Pick up a roommate

- Sell used stuff online

My Experience

It’s no secret that we have a two-family house, hence the title of this blog.

I was unfortunately not of the “asset employing mindset” while I was paying off student loans, and therefore did not leverage anything to my advantage.

However, now that we do have a very significant asset working for us (i.e. our second floor apartment), I can heartily say that I really, really wish I had done something like this sooner.

I did, however, get started selling used stuff online while I was paying off my student loans.

Over the years I’ve pocketed over $4,000 just by listing items on places like Mercari, ebay, Poshmark, and Craigslist.

See also:

- How to clear house before an exciting life change

- How to Sell Used Stuff Online – get more money & space

Perks

- Get rid of stuff!

- Keep stuff out of landfills

- Provide goods or services

Possible Income

Depends on the asset.

A long term apartment rental could gain $300 – $3,000/month, depending where you live.

An Airbnb depends on “heads in beds” and location, but $40 – $200/night seems reasonable.

Selling things online depends on what you sell, but I’ve made anywhere from $5 (books) – $400 (vintage computers) per item.

Is there an asset in your life that you can leverage?

Final Thoughts on Side Jobs to Pay off Student Loans

Leveraging side jobs to pay off student loans might not mean debt freedom overnight, it WILL pay off!

With a little bit of discipline, continued budgeting, and dedication, you will be free of your debt.

You will.

Just keep on keeping on!

You may also like:

- 9 BEST budgeting resources

- Personal Finance for Beginners – how to DOMINATE your money!

- How to Budget for Buying a House