How to Prioritize Home Projects

This post may contain affiliate links. If you purchase a product through one of them, we will receive a commission at no additional cost to you. As Amazon Associates, we earn from qualifying purchases.

This post is all about how to prioritize home projects.

Ah, the age old question: “Where do we even start?!?!?!”

There’s that pull between, “I want this screaming Joanna-Gaines-wuz-here” and, “how much is left in my bank account?”

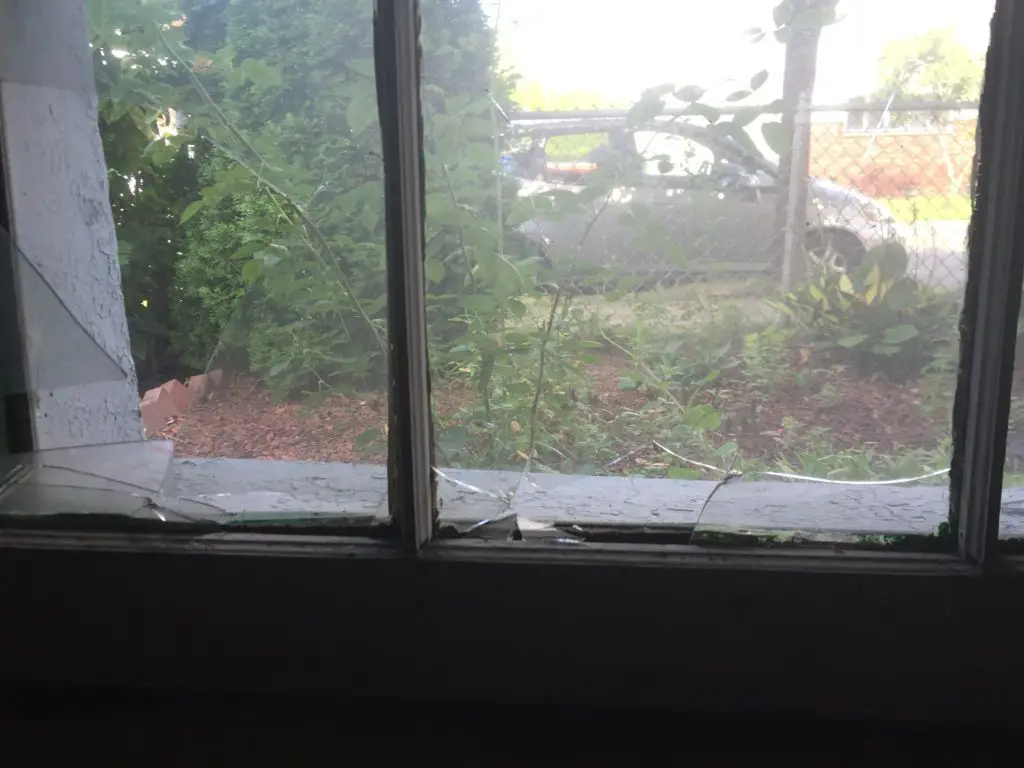

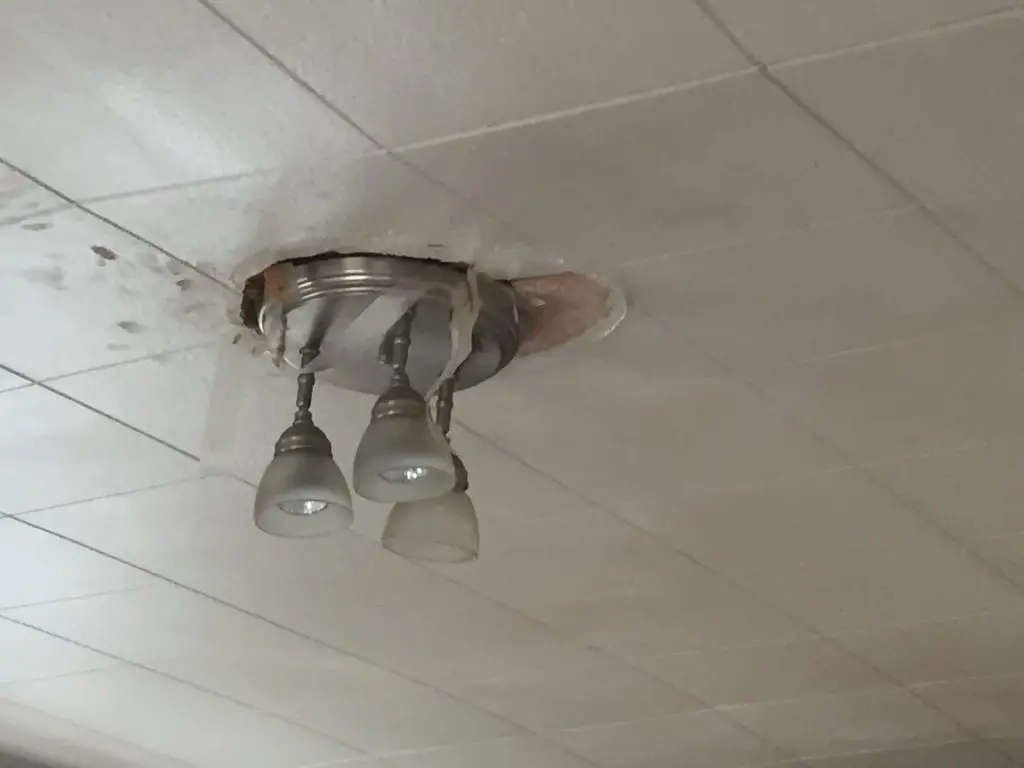

We know this feeling. When we closed on our two family, we had one functional sink amid 2 kitchens & 3 bathrooms, the roof was leaking, the windows were broken…

Where do you even start?

Thanks to living through it, we have a few ideas.

Here’s our best advice on how to prioritize home projects.

Insurance

If you’ve newly purchased your house, your insurance will tell you what to fix first. If your house is even insurable, that is.

We bought a foreclosure which was uninsurable.

A traditional mortgage coupled with a call to the Gecko, Flo, Jake, and the squawking duck wouldn’t insure our property.

We had to go with an FHA 203k, enabling us to purchase our two family house with a mortgage and wrap the construction loan into said mortgage. The only other way to make that possible on our house was to buy it in cash – very common with foreclosures.

So, what to fix first? The basic list of “make it insurable” requirements included:

- staircases where there should be staircases

- functioning heat & plumbing,

- flooring that wouldn’t cause tripping,

- lead paint no longer chipping

- windows that weren’t broken.

FHA cared nothing about the ugly color on the walls, the rickety staircase, the electrical fixture held up with scotch tape… a priority for some, but not our FHA 203k loan.

Our eventual insurance did have another requirement after closing, and that was fixing the sidewalk in front of our house. A big bump between pieces of concrete, often caused by tree roots, is a trip hazard.

Out went another thousand bucks… but better safe than sued, right?

In any case, satisfying your homeowner’s insurance policy is essential when deciding how to prioritize home projects.

Safety

Safety, beyond your insurance company requirements, will be next on your home projects priority list.

In our experience, this involved things like plumbing and electric. If there’s something unsafe in your home’s wiring or plumbing, head there next.

Also – maybe this is obvious – but things like lead paint, asbestos, radon, mold… you should probably fix those things next, if insurance hasn’t already made you.

If you’ve just recently purchased a property, your home inspector will hopefully have alerted you to anything suspicious in your home.

Water

Avoid water! At all costs! Water coming from the sky or a local river belongs outside, not in your house. If you’re wondering how to prioritize home projects, keeping water out should top the list.

Examples of water-related issues you should repair STAT include:

- Roof

- Flooding basement

- Leaking pipes

This might mean repairing your roof. Or, it could mean installing a sump pump or drain in your basement.

There are all kinds of ways to keep water out. Consider which is most important to your particular property.

Money

Maybe you’re considering how to prioritize home projects because you just bought it.

Maybe it’s because you’re about to sell.

Either way, you’ll want to consider the return on investment (ROI) your home project will provide.

Income Stream

For example, we renovated our second floor rental unit before renovating our first floor unit.

When we were thinking about how to prioritize home projects, we considered our income streams. We bought our two family house intentionally – that is, to “house hack” by renting out the second floor.

Now, we could afford our monthly payments even without the rental income stream.

However, it would be really really nice to have that income stream rolling early on in the mortgage. This resulted in our decision to renovate the second floor rental unit before the first floor.

Maybe you’re eyeing a spot in your home that will be an Airbnb, a storage space to rent out, or even just a portion of your driveway.

We say, get that income stream rolling! Don’t hesitate!

Private Mortgage Insurance

The other reason we fixed our second floor before the first was a technical issue called PMI.

The Long story

PMI is private mortgage insurance. If you buy a house with less than 20% down payment, the mortgage company charges you PMI to cover their butts. Want more detail? Investopedia explains PMI in detail here.

For us, PMI cost an extra $200 per month.

Some mortgages allow you to pay down your principal to the 20% mark (as in, your Loan to Value ratio is 80/20) and let you out of PMI. Some mortgages do not let you out of PMI ever, unless you refinance to a new loan.

We were in the latter category. At the time we bought our house, an FHA loan did not allow paying your way out of PMI. That’s $200, per month, every month, for 30 years. That makes $72k.

Altogether now, “No thank you.”

The way out? Renovate and refinance. Talk about a huge motivator! We had to improve the property enough for its appraised value to increase by 20%.

Soooooo, we repaired the second floor apartment from end to end, particularly focusing kitchen and bathroom for highest ROI, so that our refinance would result in an 80/20 loan to value ratio, and rid us of PMI.

The short story

We prioritized improving the property enough to refinance, and therefore lower our monthly expenses.

Annoying-ness

For us, annoying things included the color of the walls in our living room (read: PINK), the backyard makeover (though, that old metal shed was a borderline safety issue), and the trees in our front yard.

We had good reason for fixing each of these things – our sanity!!!

Projects upcoming that will also reside under this category of “annoying-ness” include my dreary basement gym space and our tired living room. (Stay tuned to the projects page – our living room makeover might just be next!!)

Maybe you’re considering a playroom for your kids, and in return you get your sanity back. Is it worth it? (The answer here is 100% yes.).

Seasons

Thinking through how to prioritize home projects, you might also consider the seasons.

There are two ways to slice this pizza.

1. Go In Season.

If you go in season, you’ll be ready.

For example, get new windows installed before wintertime.

Less draft = cheaper heating bills.

2. Go Out of Season.

If you go out of season, you might save a few bucks and get faster service.

For example, getting new windows in the dead of winter will be uncomfortable for a day, but the window company will likely be able to get to your house sooner.

They might even have off-season discounts, you never know!

By the way, did you know about the Cheapest Time of Year to Remodel your Kitchen?

Budget

Can you afford it?

If the answer is no, and your health and safety are not in danger, wait. Create a plan to save up the cash, find more affordable contractors/materials, etc.

If the answer is yes, you can afford it, then ask yourself if it’s worth it. You can do anything to a house, but will it be worth the spend in light of resale value, ROI, etc.?

Up to you! You know your budget.

If you don’t know your budget, by the way, check out our top budgeting resources. It’s never a bad time to start a budget!

Related: How to save money on home renovations.

The One Exception

There is one exception to all of the above, and that is refinishing hardwood floors.

We chose to refinish our hardwood floors before we moved into our house. It was an extra $1400 expense that we didn’t really want to shell out, however – the house was empty. E-M-P-T-Y. I do not regret for one second that we spent a few bucks to refinish the hardwoods.

Why? They are a pain in the rear the second you move in, for you will be shuffling furniture forevermore. Furthermore, dust will get on everything.

Just look at the small refinishing project we took on when we remodeled our master bedroom. We are so glad we had done the rest of the first floor before we moved in.

Conclusion

That about sums it up for how to prioritize home projects. There is so much to think about, from safety to sanity.

We hope this little post helps you figure out where to start on your home!